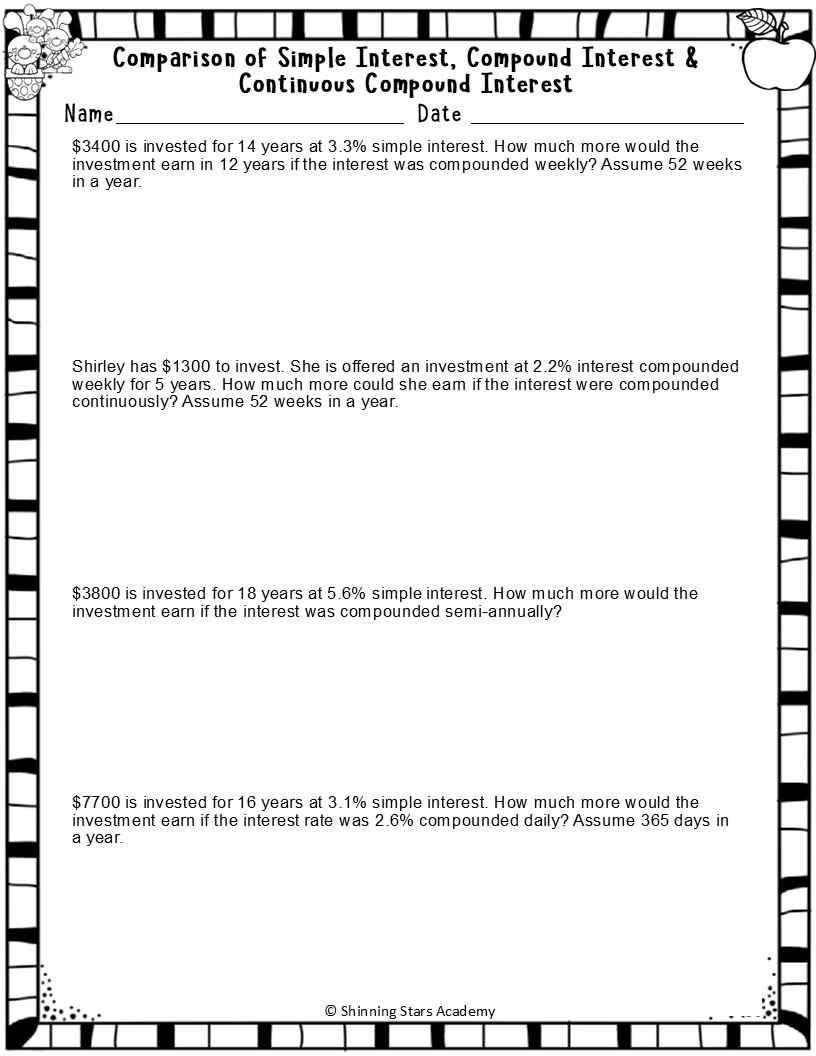

Empower your students with a deep understanding of how money grows over time through this comprehensive resource comparing Simple Interest, Compound Interest, and Continuous Compound Interest. Using real-world financial scenarios, this resource helps learners calculate, compare, and analyze how different types of interest affect loans, savings, and investments.

Students will apply formulas, use calculators, interpret results, and draw conclusions about which interest model is most beneficial in different financial situations.

What’s Included:

20+ Worksheets engaging word problems using all three interest types

Problems requiring solving for P, r, t, or A

Challenge problems for deeper thinking

Concepts Covered:

Growth of investments, savings accounts, and population models

Logarithmic solving to isolate variables

Financial literacy and exponential reasoning

Who Is It For?

Grade 8–12 students (Algebra II, Pre-Calculus, Business Math)

AP Math or IGCSE/GCSE students

College prep learners

Homeschool and independent study

Math teachers looking for no-prep, high-quality practice

Benefits:

Enhances conceptual understanding of exponential growth

Builds algebraic manipulation and calculator skills

Connects abstract math to real-life finance

Great for classwork, homework, test prep, and review

Worksheets are made in 8.5” x 11” Standard Letter Size. This resource is helpful in students’ assessment, Independent Studies, group activities, practice and homework. This product is available in PDF format and ready to print as well. AI is used in some parts of the product, where deemed necessary.

Something went wrong, please try again later.

This resource hasn't been reviewed yet

To ensure quality for our reviews, only customers who have purchased this resource can review it

to let us know if it violates our terms and conditions.

Our customer service team will review your report and will be in touch.