Grades: 9th to 12th

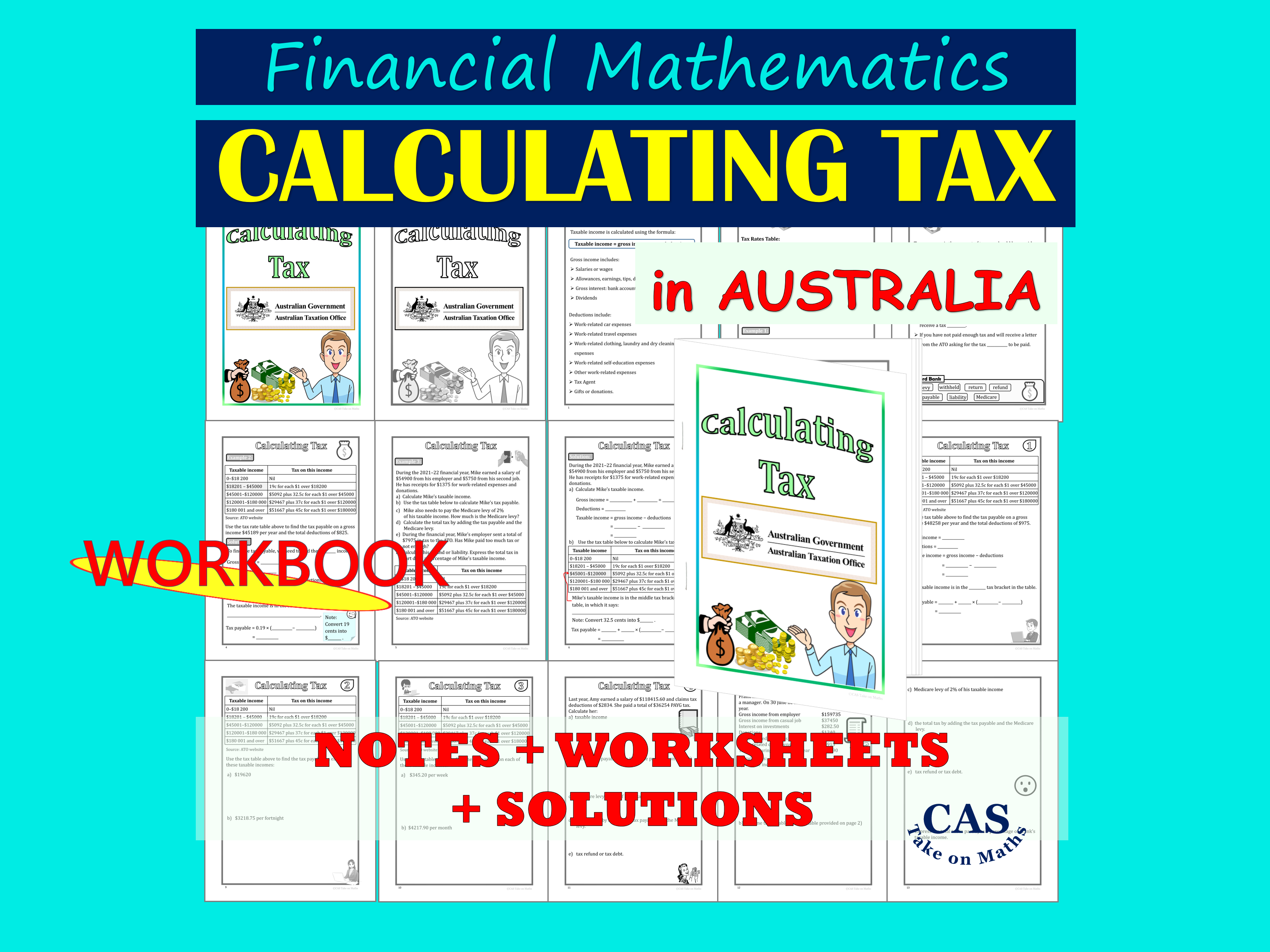

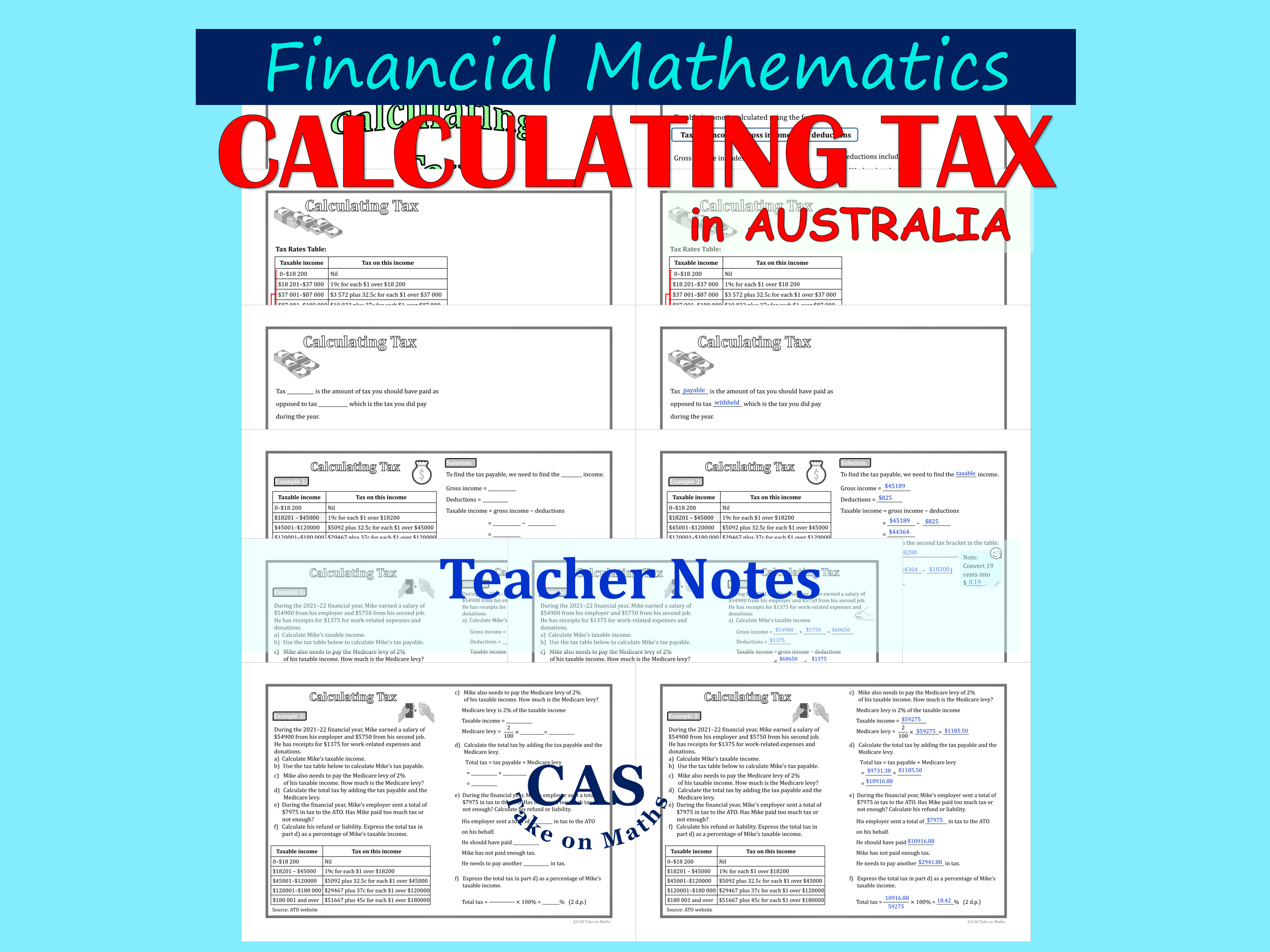

Calculating Tax on Income in Australia

Calculating Tax on Income in Australia workbooks to help students learn

and understand:

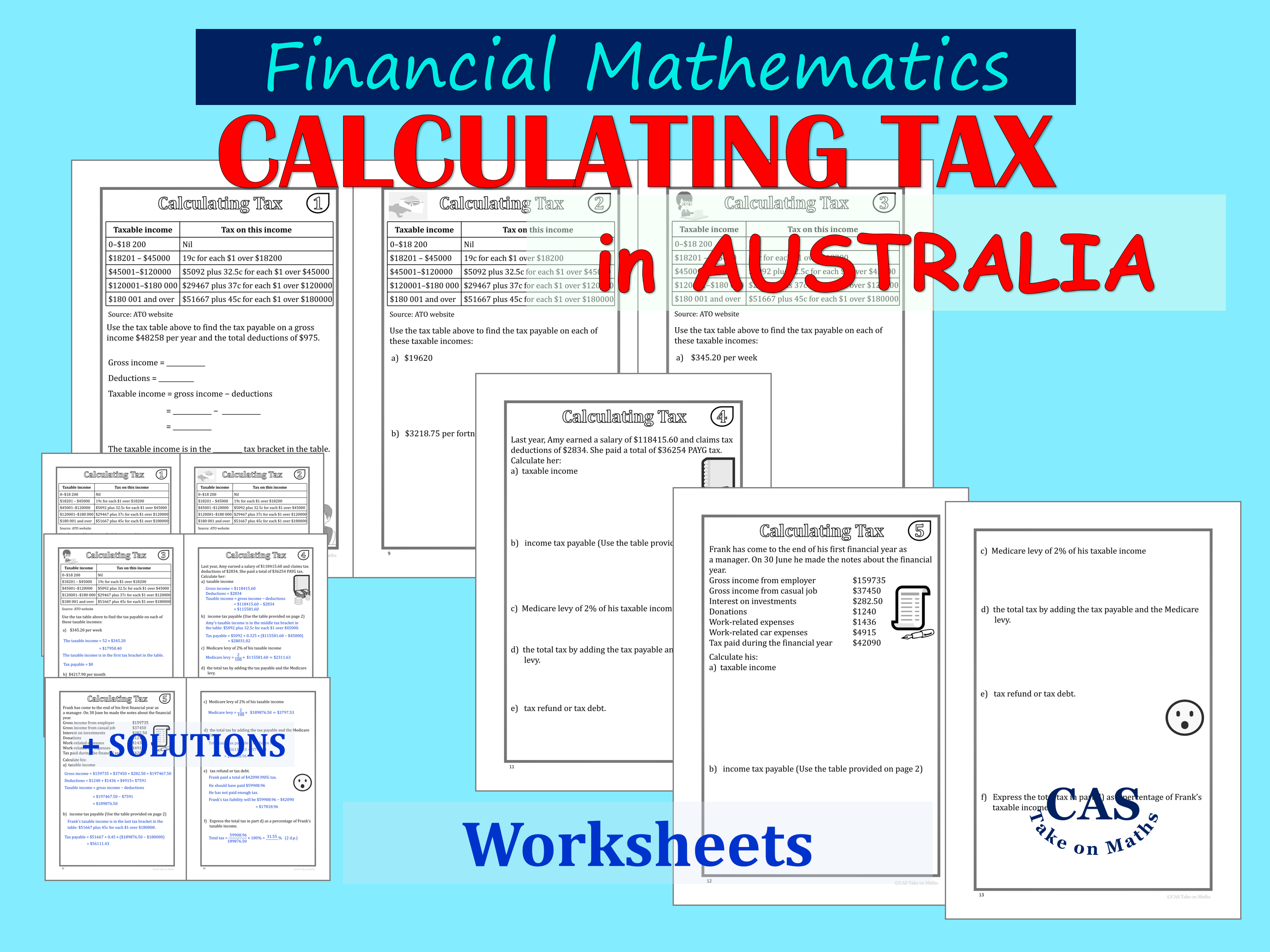

how to calculate gross incomes, deductions, individual tax income, tax payable, Medicare levy, etc.

to determine tax liability or tax refund from Pay As You Go (PAYG).

The workbook in 2 styles.

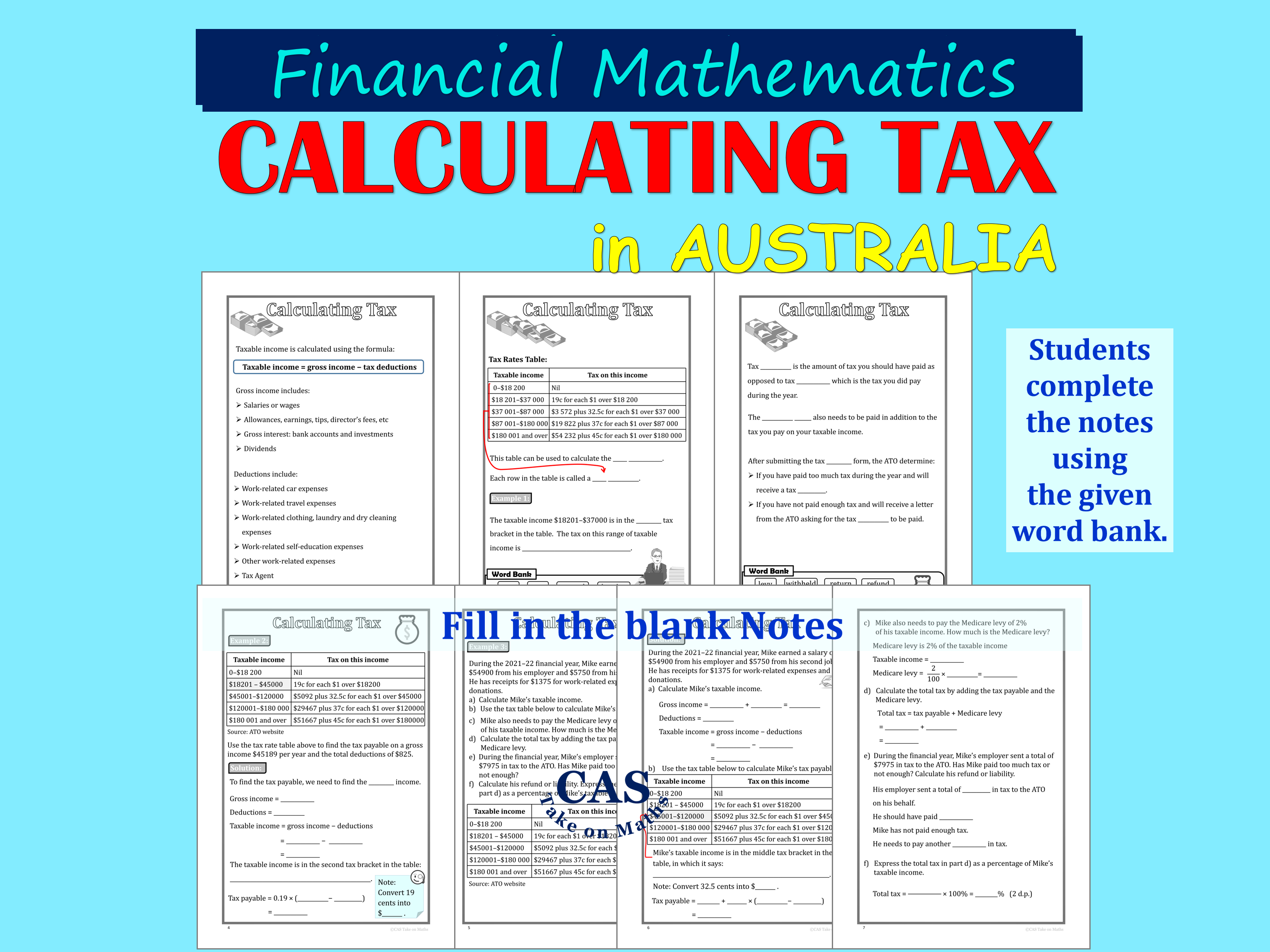

Style A: Cover, fill in the blank notes and worksheets

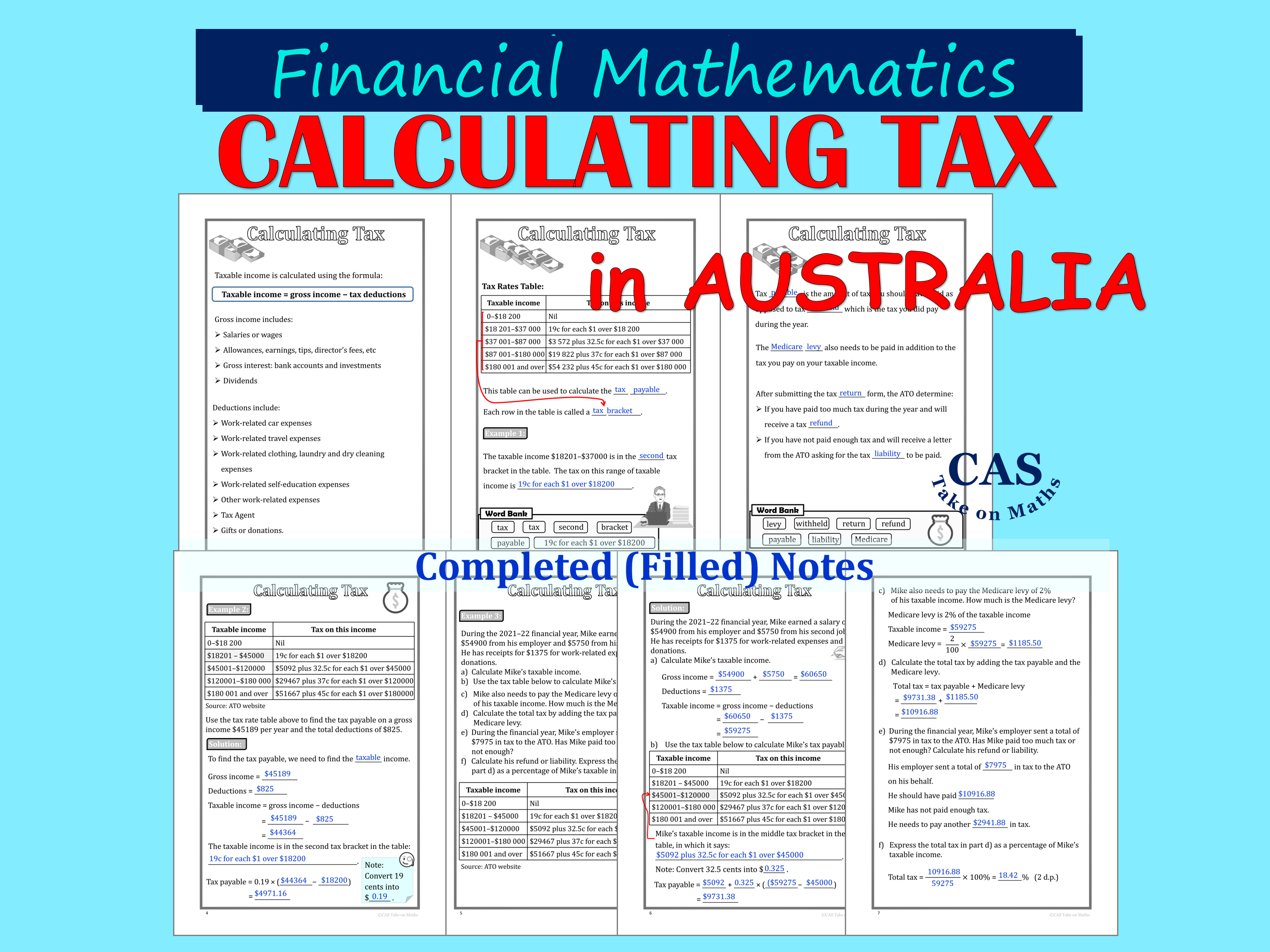

Style B: Cover, completed notes and worksheets

Total pages in each workbook: 16

Easy classroom preparation:

• For the teacher notes: print the notes on transparencies or display them on a whiteboard.

• For the workbook: print and staple all pages together to make a book.

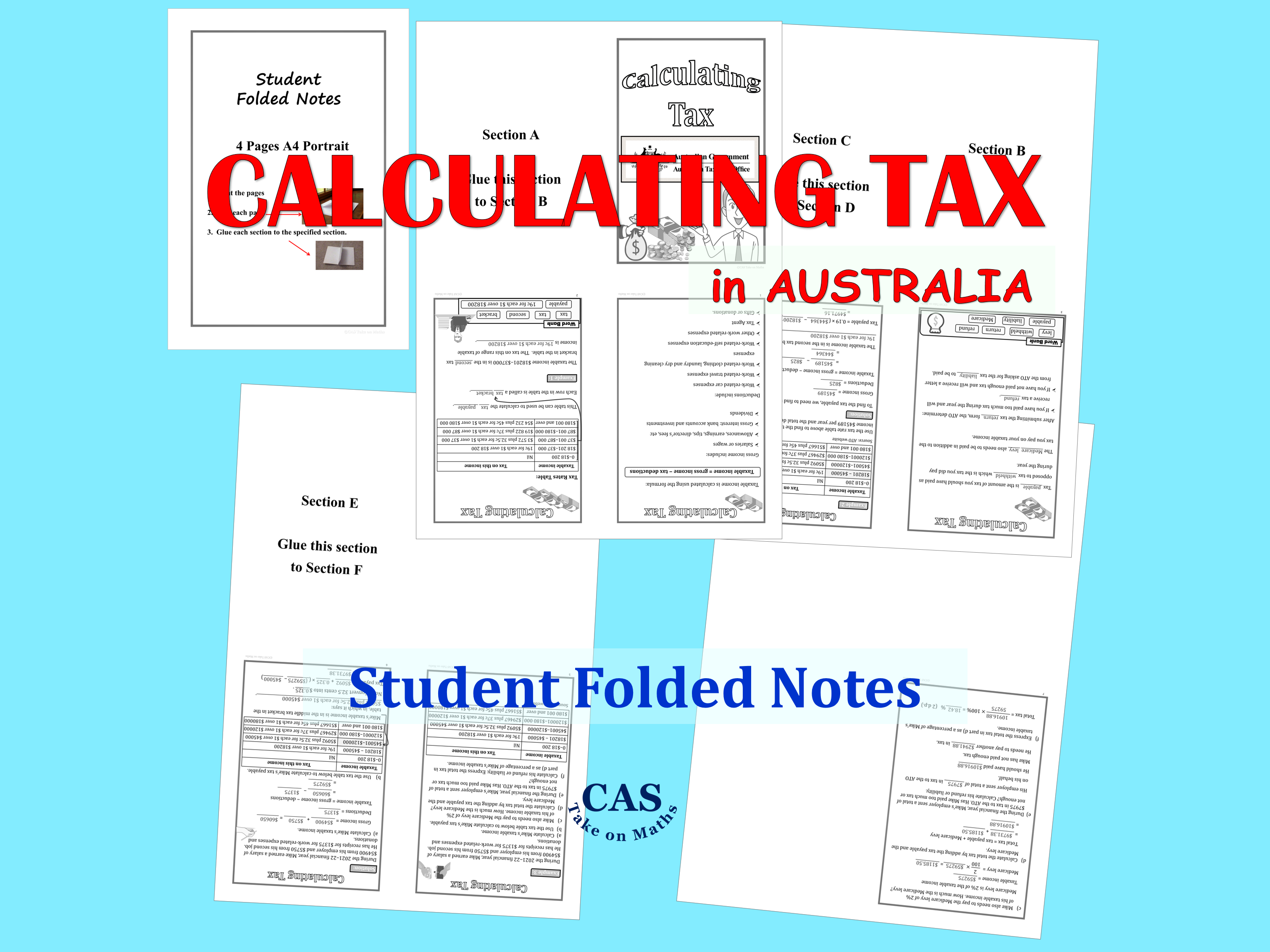

• For the folded notes: print, fold and glue the pages to make a folded notes

Learning Outcomes:

-

Understand the PAYG Income Tax System in Australia

-

Identify allowable tax deductions

-

Calculate taxable income after all allowable tax deductions are taken from gross pay

-

Calculate tax payable using the current tax scales

-

Calculate the Medicare levy (basic levy only)

-

Determine if more tax is due or if there will be a tax refund

-

Understand Australian tax returns.

Comply with Australian Curriculum:

F1.2: Earning and managing money

Something went wrong, please try again later.

This resource hasn't been reviewed yet

To ensure quality for our reviews, only customers who have purchased this resource can review it

to let us know if it violates our terms and conditions.

Our customer service team will review your report and will be in touch.